Hydrogen Engine Sales Forecast to Reach 63 in 2024, Diesel and BEVs Keep Leading the Market

According to Interact Analysis’ latest insight, after years of discussion and development, 2024 is set to be the year that the hydrogen engine market takes off. In 2024, India will move firmly into pole position due to its drive for energy independence. However, the hydrogen engine market will most likely not reach the level of […] Hydrogen Engine Sales Forecast to Reach 63 in 2024, Diesel and BEVs Keep Leading the Market published on The HeavyQuip Magazine.

According to Interact Analysis’ latest insight, after years of discussion and development, 2024 is set to be the year that the hydrogen engine market takes off. In 2024, India will move firmly into pole position due to its drive for energy independence. However, the hydrogen engine market will most likely not reach the level of diesel and BEVs due to high fuel costs and lack of infrastructure.

Trucks

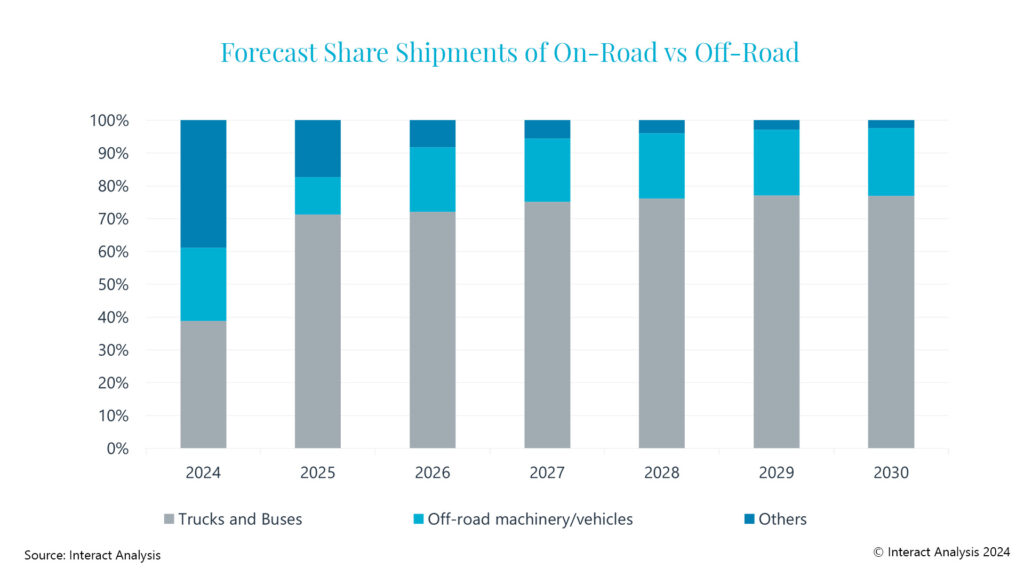

There were no new hydrogen internal combustion engine (H2 ICE) trucks registered in 2023 (excluding test vehicles). In 2024, 40 hydrogen engine trucks (new vehicles) are forecast to be sold. Most of these sales will be in India, led by Ashok Leyland and followed by Cummins through its partnership with Tata Motors. From there, a fast-growing market with hundreds of sales in 2025 and thousands in the following years is expected, reaching a forecast of 10,121 in 2030. However, with over 20 million trucks expected to be sold worldwide in 2030, H2 ICE will still only account for 0.05% of the total.

Off-Road

The off-road market, which also stood at zero in 2023 (JCB has already built many H2 ICE vehicles but hasn’t sold them for commercial use), is forecast to grow to 23 vehicles in 2024, led by loaders from JCB. Sales of hydrogen ICE telehandlers are also anticipated in the coming years, with the total off-road market projected to reach 2,720 H2 ICE vehicles in 2030. However, once again this figure must be compared with the millions of (mostly diesel) off-road vehicles sold each year.

The order Deutz received from China for gensets, plus the possibility of other orders in this area, will also add to the sales of hydrogen ICE off-road vehicles during the next few years.

Market Drivers

Sales, mainly of H2 ICE trucks, off-road machinery/vehicles and gensets are driven by the need to avoid reliance on foreign energy (in India) and for environmental reasons – climate change and local pollution (in Europe, the US and elsewhere). In addition, hydrogen engines are somewhat similar to diesel engines, and can be produced by companies with the expertise and production facilities for diesel.

Given these reasons, there will always be national or local governments, or large companies willing to take a chance on a new technology, but early sales don’t necessarily mean that a mass market will follow.

According to the insight, increasing sales of a new technology from 1%-2% to 5%-10% will only happen when the new technology is less expensive or clearly better in some way than the prevalent technology, or when existing technology is being legislated against in some way. The path to mass market H2 ICE looks very challenging given that the total cost of ownership of H2 ICE vehicles is more expensive than diesel and BEV vehicles, does not offer greater utility or more advantages vs diesel, and the existing diesel is not currently being phased out (especially in off-road). In addition, the infrastructure for hydrogen is not in place at present.

Diesel will be phased out earlier on-road than off-road, but in most on-road applications BEVs will simply beat H2 ICE on cost, and perhaps infrastructure. Long-haul trucking is more of an open question as that is very difficult for BEVs which means H2 ICE may be able to compete.

H2 ICE Won’t Reach the Level of BEVs or Diesel

The no 1 reason why H2 ICE will most likely be a niche application is that it will (in total cost of ownership) be too expensive. The high cost of hydrogen as a fuel, even after 2030, is the key problem. The second big reason is the lack of infrastructure (at least for now). It may make sense to use hydrogen vehicles near existing sources of hydrogen – such as industrial facilities, ports and solar and wind farms that are creating hydrogen with spare electricity through electrolysis. In such cases, infrastructure costs and the costs of hydrogen transport may be reduced, allowing hydrogen vehicles to be competitive.

Engineering Challenges

On a positive note, the engineering challenges that H2 ICE engines and vehicles face are being solved. Much progress has been made by companies such as JCB and Cummins on challenges relating to spark plugs, embrittlement and so on. Injector lifetime, given the lack of lubrication, is still very poor but many companies are confident that they will improve it.

So if the issues around cost and infrastructure could be solved, hydrogen would have a bright future in commercial vehicles.

This insight is based on Interact Analysis’ new H2 ICE report.

Hydrogen Engine Sales Forecast to Reach 63 in 2024, Diesel and BEVs Keep Leading the Market published on The HeavyQuip Magazine.

machineryasia

machineryasia