Summer Slowdown for Used Construction Equipment, But Values Still High

Prices at auction are up 33% over last year, according to EquipmentWatch report.

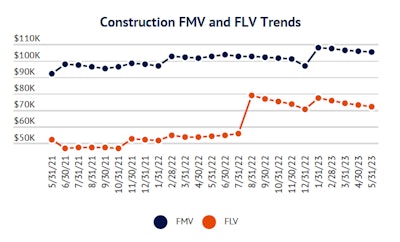

Construction equipment values have stalled on both the resale and auction channels. EquipmentWatch’s July Market Report indicates that this is an expected seasonal slowdown.

The monthly report is designed as a resource to help fleet managers make better-informed decisions by leveraging equipment values, age, and usage metrics when considering the sale, auction, or purchase of equipment.

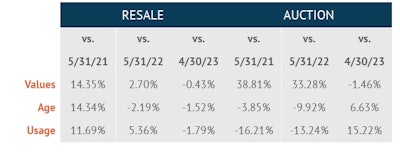

Construction equipment resale values continued their slowdown with fair market value down 1.8% since the beginning of 2023. FMV in May was down 0.43% compared to April 2023.

Values on the auction channel also continued their slowdown, dipping 1.46% month-over-month and an overall decrease of 5.5% since the start of the year.

EquipmentWatch

EquipmentWatch

The data collected by EquipmentWatch lines up with the Associated Builders and Contractors backlog indicator metrics, which continue to indicate an expectation of growth within the next six months.

Many key infrastructure projects are just getting underway, and many construction firms anticipate a robust year.

With the supply issues, OEMs are still catching up on pandemic-related order backlogs, while the used equipment market remains steady.

The age of the equipment on the resale market was down 1.52% on a month-to-month basis and down 2.19% from March 2022. The most significant jump in age was from May 2021 to May 2023 at 14.3%.

Previously reported data from EquipmentWatch indicated that the current trend of popular model years included 2015-2019.

On the auction channel, the average age of equipment in May 2023 was 6.63% higher than in April 2023. The monthly increase compared with a near 10% decline year-over-year.

Overall, the model year range is similar in the resale market as well with 2015, 2017, and 2016 being the favorite choices. Approximately one-third of firms and fleet owners opt for a particular model year.

EquipmentWatch

EquipmentWatch

Conversely, usage rates rose 15.22% on the auction market from April to May 2023. However, this compared to a 13.24% decline year-over-year and 16.21% compared to May 2021.

The monthly report from EquipmentWatch tracks resale and auction prices for over 15,000 models across 389 manufacturers throughout North America.

EquipmentWatch is owned by Randall Reilly, parent of Equipment World.

machineryasia

machineryasia