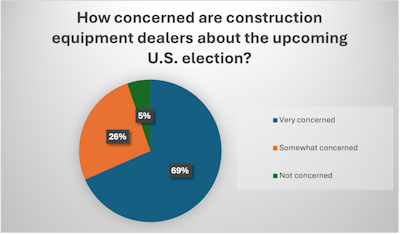

Poll: 69% of Construction Equipment Dealers “Very Concerned” About 2024 Election

More than 91% of dealers of construction equipment say the upcoming election is impacting customers’ purchasing decisions.

With the U.S. presidential election only a few weeks away, many dealers and contractors are saying they’re concerned about how it might impact their businesses.

A recent website visitor poll from Equipment World revealed that, out of 57 dealer respondents, 68.4% said they were “very concerned” about the upcoming election, while another 26.3% said they were “somewhat concerned.”

This poll was open between July and August. Some results came in before Vice President Kamala Harris took over the Democratic ticket.Equipment World, September 2024.

This poll was open between July and August. Some results came in before Vice President Kamala Harris took over the Democratic ticket.Equipment World, September 2024.

The website poll was open between July and August, with some results coming in before Vice President Kamala Harris became the Democratic nominee.

When asked what the potential impacts of the election might be, some topics dealers pointed to include persisting high interest rates, increased government spending and tax dollars getting routed away from infrastructure. Several mentioned concerns about rising taxes, regulations and tariffs under a Harris administration.

According to one Case Construction dealer, “One presidential candidate's acumen is proven in the private sector and in the presidency, and the other is part of the existing administration that has gotten us in the position we're currently in.”

One respondent who is not a dealer but operates in the used- equipment space said, “Instability in a number of construction markets including LNG, pipeline, etc., combined with high interest rates, inflation and general uncertainty has slowed the purchasing and selling of equipment in the secondary market. Many of my customers are holding off until after the election to make large capital purchases unless it is a necessity for an upcoming job.”

Just over 91% of dealers said the upcoming election is impacting their customers’ purchasing decisions. Several referenced a “wait and see” mentality among their customers, who are concerned about how the election will impact interest rates, inflation and fuel prices.

One Kubota dealer said, “The economy is a mess, and customers aren't making large purchases.”

One Develon and Sany dealer said their customers “all think the (explicative) has hit the fan” and that their used-equipment sales have dropped by 35%.

In addition to dealers, 34 contractors responded to the survey, and among them, 79.4% said they were “very concerned” about the impact the election might have on their business. Another 14.7% were “somewhat concerned.”

Key election impact concerns among contractors were changing regulations, fuel costs, inflation and material costs. One responding West Coast contractor said they’re concerned the election could put a damper on upcoming projects.

An earlier poll from Equipment World found that 47% of contractors are “somewhat optimistic” to “very optimistic” about the conditions for the industry and their businesses over the next six months. Only 25% said they were “somewhat pessimistic” to “very pessimistic.”

Equipment World’s new poll series examines the latest trends in the industry and provides insights into what contractors are thinking. Got a burning question we should ask? Send it to Jordanne Waldschmidt at jordannewaldschmidt@fusable.com.

machineryasia

machineryasia