Deadline Looms for Section 179, Bonus Depreciation for 2024 Equipment Buys

Section 179 hits a historic high deduction level, while bonus depreciation drops for the second time since 2017.

The year is almost over, but it’s not too late to take advantage of hefty tax breaks for buying or leasing construction equipment before December 31.

Though one benefit is significantly smaller than in 2022 and is on the way to being phased out, another has risen to its highest level ever.

Here’s a look at the Section 179 tax deduction and bonus depreciation on equipment purchases for 2024:

Section 179 Still 100%

The Section 179 tax deduction remains in place and has been made a permanent part of the tax code since it was raised to 100% in 2017. That means the entire cost of any new or used construction equipment you purchase or lease between now and the end of the year can be deducted on your business’ 2024 gross income.

The Section 179 deduction is also the highest in its history, after getting a $60,000 boost from last year. (Of course, thanks to inflation, prices you’re likely to pay are also higher from 2023.) For 2023, the max expense deduction has been raised to $1,220,000. The phaseout threshold on the total amount of equipment it can be applied to has also risen to $3.05 million, from $2.89 million.

Bonus Depreciation Drops Another 20%

Another big benefit from the 2017 tax change has been 100% bonus depreciation on new and used equipment purchases.

The phaseout of this benefit began last year, and it will drop to 60% of the purchase price for 2024. The depreciation level declines 20% each subsequent year until it ends January 1, 2027.

For small contractors, the drop in bonus depreciation may not be as big of a deal, if their purchases fall under the Section 179 caps.

Bonus depreciation is more often used by larger contractors and can be applied for purchases larger than $3.05 million and even over the current $4.27 million Section 179 cap.

Unlike Section 179, which is a deduction only on income, the bonus depreciation can be taken during years when the business suffers a loss.

How it Works

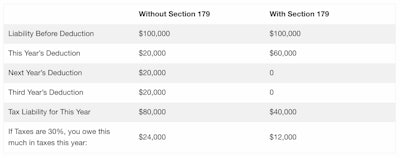

The Bottom Line blog by National Funding displays the following example of a $60,000 tractor purchase in 2024 and the potential tax benefits with and without Section 179:

The “without Section 179” assumes the standard $20,000 a year depreciation spread over three years, while Section 179 allows 100% depreciation in the first year.National Funding's The Bottom Line blog

The “without Section 179” assumes the standard $20,000 a year depreciation spread over three years, while Section 179 allows 100% depreciation in the first year.National Funding's The Bottom Line blog

Things to Consider

As with any tax break, there are rules about which purchases qualify.

First and foremost, the equipment you buy in 2024 must be put into service for your business before midnight December 31 to qualify for Section 179 or bonus depreciation for this year. There is no set amount of time the equipment has to be used in 2024 to qualify.

Of course, you can take both tax breaks in 2025, but bear in mind the bonus depreciation drops to 40% next year.

Contractors should also know that Section 179 and bonus depreciation are not just limited to construction equipment. Under certain conditions, vehicles, business software, computers, and manufacturing tools and equipment are among the other eligible expenses.

Before making any purchase decisions based on taxes, however, make sure you talk first to an accountant or tax adviser.

CPAs usually agree that making a purchase solely for tax purposes is rarely a good idea. The equipment should help your business become more profitable or efficient or both and make good business sense.

machineryasia

machineryasia