Case Dealer Titan Machinery Reports Drop in 2Q Revenue

Titan is the world's largest dealer of Case IH ag equipment and one of the largest dealers of Case construction equipment in North...

In the second quarter of its 2025 fiscal year, CNH Industrial dealer Titan Machinery reported a slight dip in its whole-goods business but a slight increase in parts and service revenue.

Titan Machinery is the largest retail dealer of Case IH ag equipment in the world, and one of the largest dealers of Case construction equipment in North America.

Total revenue generated by equipment sales was $465.2 million, which was down from $480.1 million in the second quarter of Titan Machinery’s previous fiscal year. At the same time, parts revenue was up 1.2% to $109.8 million, and service revenue was up 11.3% to $47.3 million.

Consolidated revenue for the quarter was $633.7 million, down 1.4% compared to $642.6 million in the second quarter of last year.

Gross profit for the quarter came in at $112.4 million, down from $133.4 million in the second quarter last year. Gross profit margin dropped from 20.8% in the second quarter last year to 17.7%, a decline Titan Machinery said was “primarily due to lower equipment margins, which are being driven by higher levels of inventory and softening demand.”

Titan Machinery’s second-quarter construction revenue of $80.2 million was down 3.3% from $82.9 million last year. The construction segment’s pre-tax loss came in at $4.9 million, compared to generating $5.2 million of pre-tax income in the second quarter last year. However, Titan Machinery notes that this quarter’s results were uniquely affected by a $5.1 million one-time, non-cash sale-leaseback expense.

During the earnings call, President and CEO Bryan Knutson said that while construction industry fundamentals had moderated from recent highs on economic uncertainty and lingering high interest rates, "our revenue outlook for our Construction segment is stable versus the prior year and is supported by equipment availability and new product introductions from our suppliers."

Construction equipment sales specifically in the second quarter were down 1.6% year-over-year to $52.8 million. Titan Machinery reported a same-store construction equipment sales decline of 3.2% in its second quarter vs. an increase of 18.5% in the prior year.

Titan Machinery's agriculture revenue in the second quarter was $424 million, down 9.6% compared to $469.1 million in the second quarter last year. Regarding a softening ag sector and decline in farm equipment demand, Knutson said during the earnings call:

"Through this period of softening [ag] demand, we have shifted to a much more proactive and aggressive approach as we actively work to reduce inventory to targeted levels, especially on the used equipment side, will in turn reducing floorplan interest expense," he said. "This strategy requires compression to our near-term equipment margins.

"However, the actions we are implementing will inherently shorten the impact on our performance during this period of lower demand and will accelerate our return to a more normalized margin profile as the industry cycle progresses."

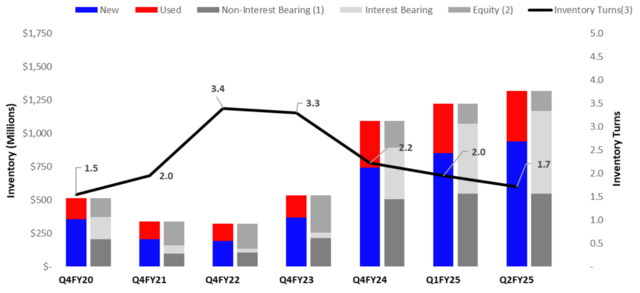

The total value of Titan Machinery’s inventory (including work in process and parts inventory) rose from $1.30 billion as of January 31 to $1.53 billion as of July 31. This included a 26.1% increase in the value of new equipment inventory to $939.9 million, as well as used equipment inventory rising 9.2% to $378.9 million in the same period.

"We expect to begin demonstrating the results of our inventory reduction actions in the back half of this year, with inventories moving modestly lower in the second half of this fiscal year, before we realize more substantial decreases in fiscal 2026," said Chief Financial Officer and Treasurer Bo Larsen.  Both the dealership's new and used inventory levels have risen in the last 6 months.Titan Machinery

Both the dealership's new and used inventory levels have risen in the last 6 months.Titan Machinery

Due to a higher level of interest-bearing inventory, Titan Machinery’s floorplan interest expense and other interest expense rose just over 251% to $13 million in the second quarter of fiscal 2025 vs. $3.7 million for the same period last year.

Outstanding balances on floorplan lines of credit rose 30.7% from January 31 to July 31 to $1.17 billion. The percentage of Titan Machinery’s inventory balance not financed by floorplan payables decreased to 11.4% as of July 31 from 18.2% as of January 31.

Titan Machinery’s new forecasts are for the remainder of its 2025 fiscal year are for its construction segment to be down 2.5%–up 2.5%, while its agriculture segment is forecast down 5-10%.

machineryasia

machineryasia